Who do you most identify with? Your bank, or your favourite clothing brand or football team?

According to Omnio CEO Adrian Cannon, the answer is a no-brainer. “I’ve been with my bank for 39 years, but no one in that bank knows me from Adam: they wouldn’t know me in the street, wouldn’t care,” he tells TechBlast.

“That’s a problem for the banks because banking should, at its best, be about relationships and trust – not just about computer algorithms.”

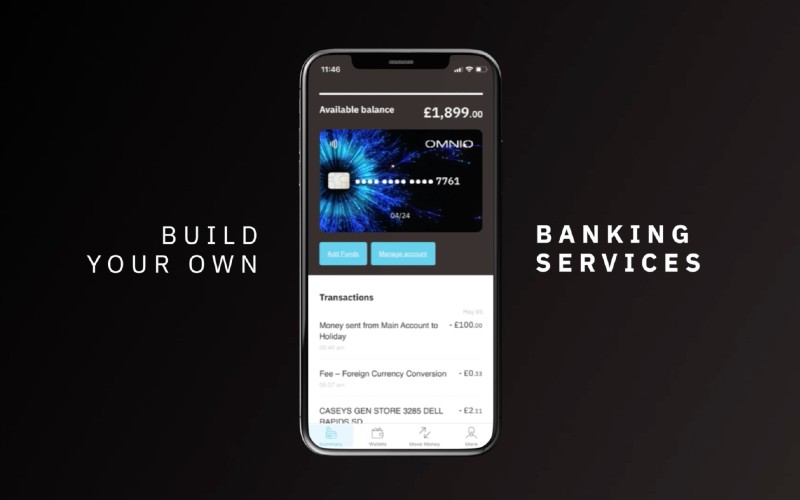

The London company’s banking-as-a-service platform allows major brands to provide financial services to customers. It is a market which is about to take off and threaten the very existence of leading banks, says Cannon – but it wasn’t the original plan for the business.

Founded by financial services and banking heavyweights including Erik Fällström, Dr Andreas Tuczka and Scott Lanphere – who had between them already built a portfolio of 29 companies – Omnio started out with the goal of helping people locked out of the retail banking ecosystem find a way back.

Backed by AEDC Capital, it set off by acquiring several UK FinTechs and bringing them under one umbrella.

“I’ve built a couple of companies myself and you always start off with a bright idea; you get a bit tech made; then you set off into the marketplace,” expounds Cannon. “If you’re really lucky, the marketplace will teach you a lesson very quickly – that it knows best what to do with what you’ve built, and your original idea is not relevant. You just have to let it go – and go with the flow.

“In our case, the market said ‘We love the idea of low-cost current account banking – but isn’t there an opportunity here to disrupt the big banking players?’ The first way of doing that was to take the tech stack, low cost-base and FinTech-like functionality and provide that into small banks, building societies and credit unions.

“These guys have a passion for their customers: they actually care about them and, better still, they actually know who they are.”

A bigger opportunity then emerged as Omnio was approached by big brands playing with the idea of embedding financial services into the heart of their customer relationships.

“Imagine a major league football club with this capability: every time you get your debit card out, you’re showing your affinity to that brand. And that brand is seeing more and more of your daily life and is better able to help you by introducing other products that, through the trust they have with you, extends the relationship.”

The easyJet Plus membership programme, for example, is driven by Omnio’s platform, while one of its companies specialises in turning payment transaction data into loyalty and rewards for European football powerhouse AC Milan and other major brands in Italy.

“You can actually get other participants in the ecosystem to fund the current account through [for example] merchant discounts or cashback, so the customer still gets free banking,” says Cannon.

“Everyone’s a winner because the customer gets a service that is as good as they’ll get from Monzo or Revolut – but with a brand they absolutely love.”

Launching: Keebo – empowering users to achieve financial wellness

As an e-money institution, the platform can be launched around the world, while the money is held by a bank with safeguarding status and so protected in full. Customers of retail banks are only protected up to £85,000 if the institution goes out of business. “Major brands with customers in the tens of millions can deliver these retail financial services in a huge area of population,” says Cannon.

“And unlike the old days of white labelling credit cards, we’re not offering credit – we don’t live off interest. This is a product that a 13-year-old can have. You can’t give a credit card to a 13-year-old football fan! But you can give our current account to that child as they grow up into an adult… and brands would start fighting for your business.”

It’s a shift which could threaten the very existence of banks and at least force them to pivot the services they provide. “Will the big retail banks just walk away? Most of them would love to shut all their branches as they don’t make any money out of retail current accounts,” is Cannon’s view.

“But if they do that, they lose that connection with their customers. So what do they become? Warehouses for other people’s money, if they have safeguarding status? Or specialists in SME banking? They’re all running in that direction at the moment.

“Some will stop being brands that we recognise and will just disappear. That revolution in banking is something I think the regulators wanted when e-money came in… it’s taken a while to get there, but we’re very close now.”

The neobank disrupters themselves also face a reckoning, says Cannon. “They’ve been very focused on the B2C play: they’ve rushed into the market and taken the cream out – anyone easy to onboard, with a good credit history and who’s not going to cause the system to flag alerts.

“They’ve run out of steam: they’re struggling to go beyond that in terms of their revenue models. Their customers don’t want to know the moment they try and monetise them.”

Retailers are also looking to free themselves from Buy Now Pay Later players such as Klarna, he adds. “The big shift in the last four months has been retailers saying to us: ‘We want to do something about the way we are being disintermediated by BNPL.

“They came into those retailers promising to grow their businesses… but they didn’t tell them they were going to market other retail brands to their customers and destroy their link with them.”

Cannon has a background of 35 years in the financial services payments space, including several years as MD of card payment specialist consultancy Witstock. He joined Omnio in August 2019 to take it from a set of assets to a pan-European business supporting millions of customers.

Valued at €70 million by a £26m funding round earlier this year, it is now processing payments worth in excess of €1 billion annually for 2m active accounts with 135 credit unions and an increasing number of brands.

“The lesson of the last two years [of COVID-19] was to stay agile, not panic and work the problem,” he says of how clients and potential clients in the retail space were affected.

“We’ve had some serious knocks – but we’re moving forward again strongly. That customer profile is set to change quite quickly in terms of the balance between banking versus non-regulated entities.

“We’re going to see the business growing very fast in the non-regulated space.”

Returning to the theme of listening to the market, he offers this tip to aspiring entrepreneurs.

“Focus on your target market – and nothing else,” he advises. “All the management handbooks in the world won’t teach that clearly enough. Who is going to buy your product and why? If the answer to that question is ‘I’m not sure and it’s going to be a bit difficult to persuade them’, that is just a hard road to a slow death.

“What you need is people actively coming to you. And a product where they say: ‘Yep, I get it. I want it, make it happen.’ If you’re having to do the hard sell every time, you probably haven’t got the product or the market definition right.

“But have the humility to recognise that the market is going to teach you what it wants: if you try and force it [to accept your existing product], good luck with that. I hope you’ve got deep pockets because it can take a long, long time.

“Too many businesses in this space, certainly in the FinTech space, have a blindingly good idea driven by some technical people and then discover that nobody wants it. And instead of taking the advantage that they have and repositioning it, they keep flogging that dead horse – and that dead horse will not come to life.”