Who?

Monevium is a brand name of Advanced Wallet Solutions Limited.

Why?

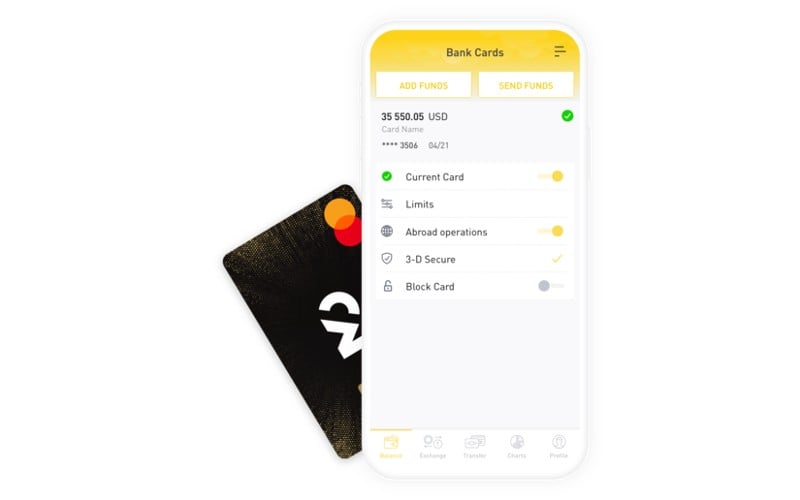

The FCA regulated company provides fast and secure payment facilities to manage everyday finances. With the Monevium Euro IBAN account, users can send and receive funds worldwide, as well as transfer funds between Monevium customers, and the launch of the mobile app makes this process even simpler.

What?

Features include the ability to order virtual debit cards as well as physical debit cards directly from within the application. Monevium customers can view all card and account statements on a real-time basis from within the application, as well as retrieve previous statements with ease.

How?

Account holders can make international payments via the SWIFT network or Single Euro Payments Area (SEPA) system from within the application. Many traditional banking systems require their customers to log onto web pages in order to conduct international transactions rather than facilitating them via an app. Monevium account holders can transact quickly and easily between each other via peer to peer (P2P) payment functionality.

Where?

Monevium is based in London.

They say:

Alexey Stepanov, MD: “The Monevium mobile application is here to further the ‘mobile-first’ nature of everyday life in the modern economy. Monevium customers are very much at the forefront of the modern way of living, and the array of features provided by the mobile application make keeping track of transactions as well as managing new ones effortless, regardless of location, all in one place, on one user-friendly platform.

“This is just the first step in our mobile journey. We have a vast amount of features planned to roll out over the coming months, which include a corporate app with corporate cards; balance top ups from debit cards; support for more currencies; and many more, which will only serve to improve the experience our users have with Monevium.”