The number of investors becoming ‘activists’ through investment platform Tulipshare rose by 133% in Q2 compared with the first quarter of the year.

At the height of ‘AGM season’, the London startup said investors are increasingly demanding that companies do more on ethical issues.

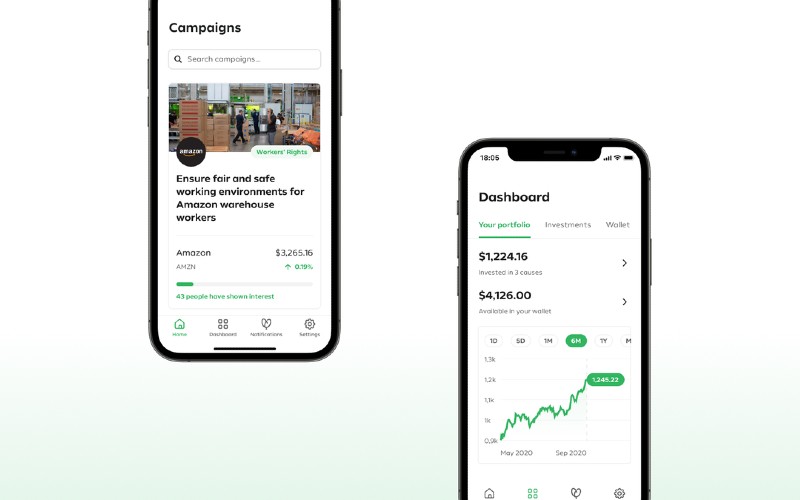

Launched in July last year, the FinTech allows individual investors to buy stock in companies and back campaigns that call for change on issues – from race to workers rights – at those organisations.

Despite owning just 13 shares collectively, Tulipshare’s campaign calling for Amazon to investigate working conditions was supported by 44% of Amazon shareholders, including some of the company’s largest investors such as Schroders and L&G.

Tulipshare’s proposal would have passed had it not been for founder Jeff Bezos, who controls 9.8% of shares and voted against the audit.

The startup was successful in putting forward three out of four proposals this year, benefiting from the US Securities and Exchange Commission’s revised guidance that made it tougher for companies to restrict proposals from ballots.

The proposals included asking Johnson & Johnson to end the sale of talc-based baby powder after it was found to contain asbestos, and asking Salesforce to investigate its racial equity after a series of complaints about the firm’s diversity practices.

The number of UK users on Tulipshare’s platform surpassed 15,000 in Q2 – with 44% of them Millennials.

“Tulipshare launched a year ago with a mission to bring activist investing to ordinary investors,” said CEO and founder Antoine Argouges.

“We have been overwhelmed by the response from investors, who are clearly seeing that investing to change companies from the inside out as a way to protest and as a form of activism. We’ve also received considerable support from some of the largest investors for our proposals – which shows the potential for collaboration between larger investors and retail investors who have historically been silenced.

“There is still a long way to go, however, and we are excited for our launch into the US market and to announce our 2023 campaigns in the coming month.”