Who?

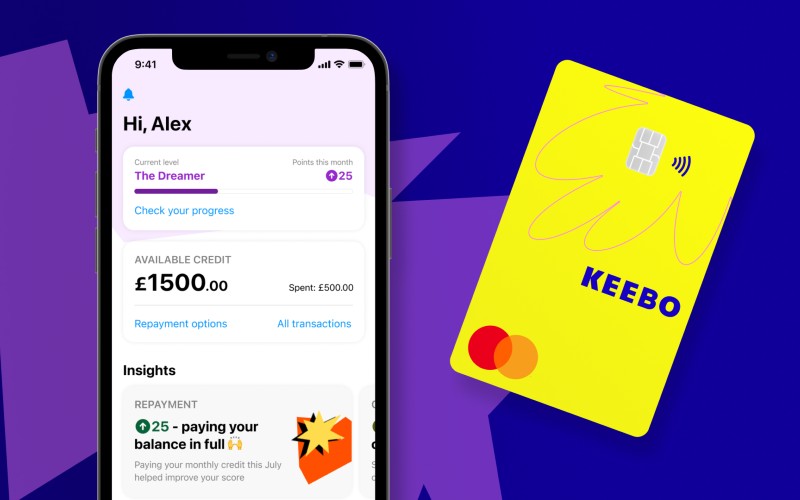

Founded by Michael Vanaselja (CEO) and Matthew Hallett (CTO), Keebo is a new credit card and mobile app that is changing the current credit system by empowering users to build their credit and achieve financial wellness. Keebo is the only regulated credit card company for open banking based underwriting, improving access to credit to more responsible candidates.

Why?

Keebo recognises the impact that financial exclusion has amongst the ‘passion economy’. Often young, with limited credit history and irregular income, these consumers are excluded from traditional forms of credit as their lifestyles and careers do not fit with the existing models of creditworthiness. Keebo is focused on tackling this financial exclusion by providing fairer access to building better credit.

What?

Keebo is launching in beta with Mastercard, helping people unlock the power of credit and build the lives they dream of.

How?

Keebo uses open banking to look into a customer’s broader financial behaviour and create a more accurate picture of the customer’s creditworthiness. By giving people insight into every action and transaction they make on their Keebo card – including spending habits, savings, and investments – users will become empowered to build credit, avoid bad debt and achieve financial wellbeing.

Where?

Keebo is based in Spitalfields, East London.

They say:

Michael Vanaselja, CEO and co-founder: “We’re thrilled to be launching Keebo beta. With so many people excluded from accessing credit in the UK, our goal is to open up credit to those who have been unfairly excluded by the current model such as youth, freelancers and content creators and help them build towards their next step. We look forward to launching next year.”