Cornerstone VC, born out of black-led angel group Cornerstone Partners, has launched a £20 million fund to invest in exceptional entrepreneurs in the UK from diverse backgrounds.

The fund will focus on tech-enabled companies at pre-seed and seed stage, typically investing initial cheques of between £250k and £1m with capital reserved for follow-on funding.

It plans to invest in up to 40 companies with a significant proportion based outside of London. In a twist on the traditional VC model, Cornerstone’s angel network will also receive a share of the fund’s profits via carry participation.

Cornerstone VC’s mission is to establish a leading VC firm with a diversity-led investment strategy that unlocks outperformance and delivers returns for investors. It will target management teams with inherent (such as age, gender or ethnicity) and acquired diversity (social capital) and address the equity funding gap for entrepreneurs that are too often overlooked and underestimated by the wider funding community.

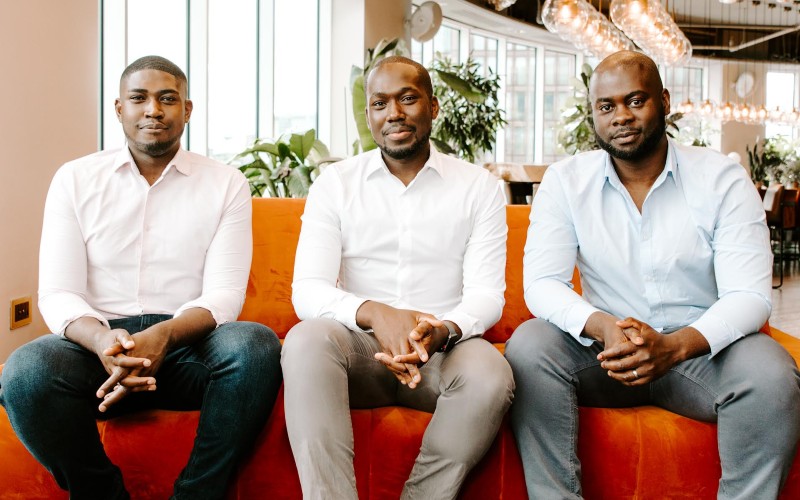

Cornerstone VC is led by Rodney Appiah, founder and managing partner, alongside partners Edwin Appiah and Wilfred Fianko. Rodney co-founded Cornerstone Partners in 2016, is a non-executive director of UKBAA and Conduit Connect, and was formerly an investor at BGF and Foresight Group. Recent investments from the team’s pre-seed angel portfolio include ByRotation, Passionfruit, Hutch and MoonHub.

BGF, the UK’s most active investor of growth capital and The Hg Foundation, a grant-giving charity with a mission to remove barriers to education & skills in technology, both led the first round close, as well as others including Atomico, one of Europe’s leading VC funds focusing on Series A and beyond. Other investors include Nic Humphries and several senior partners from Hg, a leading software and services investor, as well as other individual investors including former BVCA Chair Neil Macdougall, Scott Mackin, Jamie Broderick, Stefan Ericsson and Sidumiso Sibanda.

“We are on a mission to put teams at the heart of our investment approach, believing diversity is key to driving outperformance,” said Rodney Appiah. “We are looking for businesses that are intentional about team composition, can excel in high growth environments and are truly obsessive about execution. People first, software second.

“Contrary to perceptions around a pipeline problem, we don’t see any evidence of that. We meet more than 500 diverse founder-led businesses a year and our own data indicates that there is a growing pipeline of high-growth, innovation-led investment opportunities led by diverse founders, particularly at pre-seed and seed stage requiring further institutional investment.”

Rodney Appiah has served as a committee member for Lloyds Banking Group’s Black Business Advisory Committee, Innovate UK’s Credit Committee and the London Chamber of Commerce and Industry’s Black Business Association. He previously chaired the CBI’s London Under 35 Committee.

Edwin Appiah currently serves as an IC member of Imperial College’s Enterprise Fund and was a former International Banker at Coutts, advising more than 100 owner manager businesses across the US and Europe.

Fianko currently serves as a board observer at a leading LSE-listed private equity firm in the UK and was formerly a senior management consultant at UBS and KPMG, specialising in financial services transformation.