In a groundbreaking move to boost home energy efficiency in the UK, the government has earmarked up to £16 million for the support of 12 innovative projects. These diverse initiatives, spanning from novel solar panel subscription services to green mortgages, are strategically designed to lower energy bills for households and cut down on carbon emissions, representing a major leap forward in the pursuit of sustainable living practices.

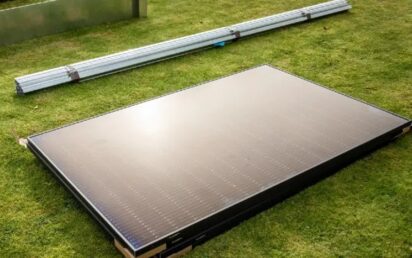

Among the most notable of these initiatives is Sunsave’s Electric Roof (pictured), which has been allocated a significant £1.9 million in funding. This project is set to revolutionize the solar panel market by introducing a subscription-based model. This innovative approach effectively removes the prohibitive upfront costs typically associated with installing solar panels. Homeowners subscribing to this service will be required to pay a monthly fee that covers not only the maintenance of the panels but also grants them access to ‘smart tariffs’. These tariffs vary electricity rates throughout the day, thereby maximizing potential savings for the consumer.

E.ON’s Energy as a Service is another project that stands out, having secured £1 million in funding. This comprehensive program is designed to offer both energy-related advice and financial support to as many as 350 households. The aim is to facilitate the installation of low-carbon technologies such as heat pumps, solar panels, and battery storage, all of which are crucial in the transition to greener energy sources.

These projects are part of the broader Green Home Finance Accelerator program, designed to facilitate new financing methods for home energy efficiency improvements. Lord Callanan, Minister for Energy Efficiency and Green Finance, highlighted the government’s commitment to reducing the financial strain on families while promoting energy-saving measures. This program is a continuation of the government’s efforts to make sustainable home improvements both accessible and affordable, aiming to directly contribute to an increase in household savings in the UK.

Additionally, the program includes a variety of other innovative projects. Perenna, for example, has been granted £888,000 to develop a long-term, fixed-rate green mortgage. This novel financial product is designed to incentivize homeowners to adopt energy-efficient practices by offering lower mortgage rates for homes that meet certain energy efficiency criteria. Chameleon Technology’s HTC-Up project, with funding of £795,000, plans to offer customized green loans and cashback rewards. These financial incentives are intended to encourage both homeowners and landlords to invest in making their properties more energy-efficient.

Scroll Finance Limited’s Glocers Project, which has received £1.5 million, is set to pilot an inventive scheme that leverages home equity to fund the installation of energy-saving measures. This method offers a flexible and affordable way to cover the upfront costs associated with improving home energy efficiency.

Emma Harvey-Smith, Programme Director for the built environment at the Green Finance Institute, emphasized the importance of these innovative and affordable financing solutions in enabling homeowners to upgrade their homes for energy efficiency. These solutions not only reduce utility bills but also contribute to emission reductions. The Green Finance Institute continues to play a vital role in developing the market for green finance, supporting the UK and Europe’s ambitious decarbonization goals.

The funded projects are scheduled to run until February 2025. During this period, they will implement and test their solutions with homeowners across the UK. This strategic initiative is part of the larger £20 million Green Home Finance Accelerator, itself funded through the £1 billion Net Zero Innovation Portfolio. This extensive funding and the projects it supports underscore the government’s unwavering commitment to fostering a sustainable and energy-efficient future for all.